With the start of another new year, it might be a great time to review your investments and your overall financial plan. Investment planning and management requires myriad steps. It is prudent to revisit your plan and check that the steps you have taken are keeping you on track. Here’s 22 steps you might do in 2022.

- Know Yourself

An individual must know him/her-self to be a successful investor. This is the ‘Be true to you’ rule. Knowing the investment parameters and constraints unique to you will help you stay true to you.

- Be Disciplined

Investing is not for the undisciplined. A disciplined approach to research, and investment rules are critical to success. Be intentional and precise, not arbitrary

- Go With What You Know

Being aware of what you trust, buy, use, and like can lead to a common-sense approach to investing. “Invest-sense” is a term I use to imply the combination of intuitive common sense and a sound psychology leading to successful investing.

- Control You Emotions

To be a successful investor you must control your emotions. We are only human, so fear and greed are unavoidable for investors. Try to not make investment decisions when feeling FUD or FOMO: Fear, Anxiety & Doubt. And, Fear Of Missing Out.

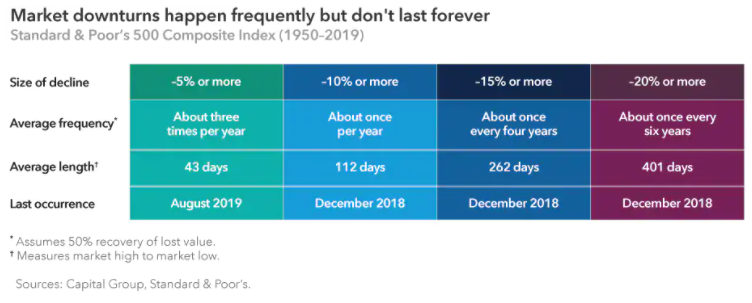

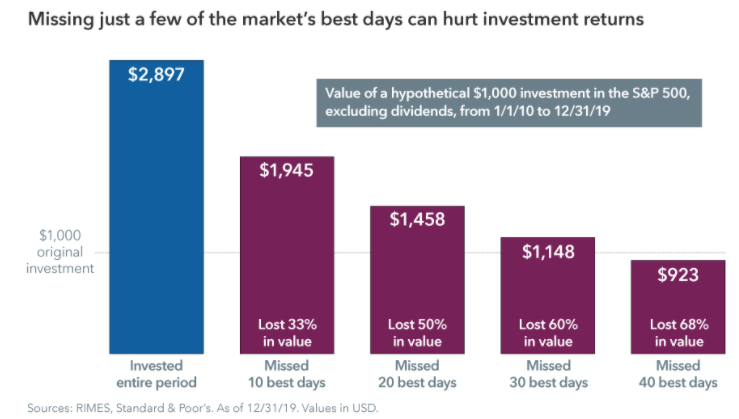

- Remember, it’s Time-in, Not Time-ing

A key to successful investing is time; it is the amount of time in, not the timing, that matters. Time in the stock market does two things: It reduces risk and avoids the cost of being out. The longer the time in the market, the lower the risk.

- Minimize Losses & Maximize Gains

Cut your losers … let your winners run. Avoiding large losses and holding on to gains precludes potentially unrecoverable losses and allows for big winners in a stock portfolio.

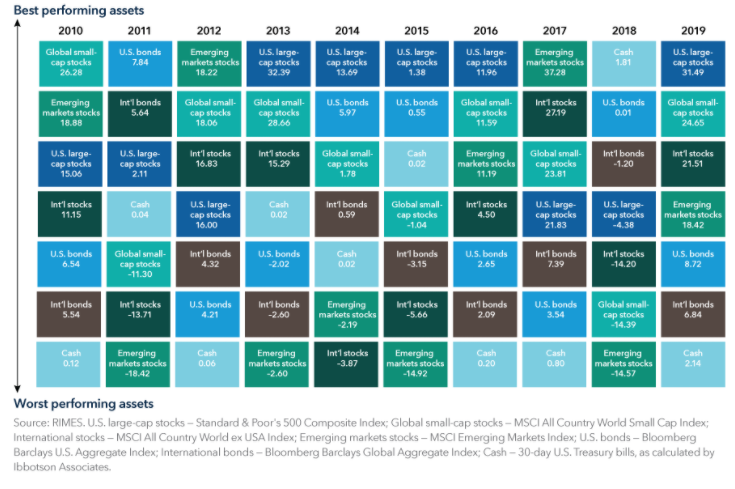

- Concentrate for Accumulation & Diversify for Preservation

Too much diversification can dilute profit potential. Too much concentration can be dangerous, also. Knowing your investor-self will help you with concentration vs. diversification.

- Be Contrary, not Ordinary

Contrarian investing was famously expressed by Baron Rothschild, who said “The time to buy is when there’s blood in the streets.” Contrarian investing can feel counter-intuitive. But can also provide you the most profit.

- Put Risk Before Return

“Investing is a process that should be based on a disciplined approach to risk management.” My quote. Strive to minimize the risk inherent in all investments before chasing returns.

- Put Process before Product

Investing is a process. In fact, it is a never-ending process. Have a strong understanding of the investment planning process before buying any investment product.

- Plan your investments & invest your plan

SCUBA divers honor the rule, “Plan your dive, and dive your plan”. Apply this approach to your investing.

- Check your Titles and Beneficiaries

Your investment/savings accounts and properties are uniquely titled, and some have designated beneficiaries. With years gone by and with life changes, it may time to check your holding’s titles to ensure they are what you want and pass on to whom want.

- Maximize your contributions

If still working, contribute early and often to your retirement savings accounts. Max-out your allowed contributions, including your “catch-up” allowances if over 50.

- Minimize your taxes

A way to maximizing investment returns is to minimize investment taxes. A prudent investment plan includes tax reducing strategies. Seek tax exemptions, tax deduction, tax deferral and tax advantaged investments and techniques.

- Consolidate accounts

Create easier management and oversight, reduce fees, avoid unintended duplication, and gain more clarity of your full financial picture. All that by consolidating your investment accounts.

- Trust but verify

This is a Russian proverb adopted and made popular by President Ronald Reagan. Apply it to your investment selection process. You hear from a trusted person about a “great investment”. Place your trust wisely and verify.

- Think thematically

Thematic investing generally means buying stocks or other investments that may benefit from a particular trend. What trend might be your friend in 2022?

- Think “Buy high & sell higher” not “Buy low & sell high”

It’s one of the most common investment adages. Who doesn’t want to profit from buying low and selling high? Though counter-intuitive, buying high and selling higher can be a less risk, more return approach.

- Consider conversion

Converting some or all your traditional IRA to a Roth IRA in 2022 may be good for you. A Roth IRA conversion can save you considerable money in taxes over the long term, especially if you see your taxes rising in the near term.

- Don’t risk a lot to gain a little

My dad taught me this. He was a great stock investor.

- Focus on your plan

“How is the market doing?” is a common question. The question should be, “How is my plan doing?” Your income needs being met, risk levels consistent with your tolerance, and appropriate asset allocation should be your focus.

- Be happy and healthy in the new year.

I saved the best for last… HAPPY NEW YEAR!!