Last year at this time, I called 2020 the year of “Resiliency Amongst Uncertainty”. Like everyone else on the planet then, I had never heard of COVID-19 and a world overtaken by a pandemic was the last thing on my mind. So, I had no idea how right I was expecting investor uncertainty and market resiliency this year. We all know now 2020 has been a year of unprecedented uncertainty, stock price volatility and amazing market resiliency. Good-bye 2020 and HELLO 2021! As always this time of year, I look forward to the new year. Hope you enjoy my 2021 Outlook.

“Less stress and more fun in 2021” is what I am calling next year. Two huge contributors to investor’s anxiety in 2020, COVID and the presential election, are thankfully likely to bring less stress in 2021. November brought high hopes for a coronavirus vaccine with two promising cures: one that showed a nearly 95% efficacy and another indicating 90% effective and, with hopefully a smooth transition in the White House in January, Election 2020 is history. No doubt other issues we can think of, and some we can’t, will surface to cause investors concern next year. So, expect the usual bouts of spikes in market volatility in 2021. Below are my insights and forecast for the U.S. stock market and economy in the new year.

Stock Market Outlook

I have said for decades that earnings matter most when evaluating stocks and the major stock market indexes. Expectations are for a sharp rebound in earnings in 2021. With a $175 earnings target for the S&P 500, my outlook is for a higher stock market next year. However, how much higher depends on a lot, especially investor confidence. Without a big boost in confidence, the stock market may not deliver high returns in 2021. Perhaps the foundation of fundamental stock analysis is the Price-Earnings Ratio (P/E ratio). The P/E ratio is the ratio between current share price and per-share earnings. When dividing earnings into price, we get a “multiple” – in other words, how much investors are willing to pay for expected earnings. The more confidence, the more the multiple. Since the early 1970’s, the average P/E for the S&P 500 has been about 20. Applying that historical P/E to earnings expectations of $175 for the S&P 500 next year, we get 3,500. That is lower than where the index is today (3,610 November 16, 2020). That doesn’t sound good. So, to get a higher stock market next year (S&P 500) we will need either higher earnings OR greater confidence (higher multiple). A P/E of about 23 takes the broad stock index to 4,000. That is about a 10% gain in the S&P 500 from today, but also a P/E ratio about 10% above the norm. As noted above, higher investor confidence in stocks should yield a higher rate of return to stock investors.

A common question among stock investors looking ahead to next year is: Will the “rotation” continue? It’s a good question, and a macro market dynamic you will likely hear much about. So, what does this mean? The question speaks to which class of stocks are gaining the market’s favor. Specifically, will “reopening/recovery” stocks outperform the “stay-at-home” stocks? Generally, this rotation phenomena is about “value” vs. “growth”. Clearly, the “coronavirus bull market” winners were the stay at home stocks. Think Peloton, the stationary bicycle company. Those type of stocks jumped as economic sensitive stocks, such as travel and restaurants, were dumped. This situation has been in place since the outbreak of the global virus. During this time growth stocks dramatically outperformed value stocks. Then came the early November news of a late-stage, highly effective COVID-19 vaccine and the second, even better, vaccine announcement a week later. Immediately, the rotation began – COVID beneficiary stocks that had gone up so much began to fall as stocks that were deeply beaten down rose sharply. So, will this rotation continue and be a theme in 2021? The virus still controls the U.S. economy, and therefore, will determine when economic sensitive stocks rebound with earnest. Speaking of the economy next year…

Economy in 2021

As I mentioned above, the virus still controls the U.S. economy and will in 2021. The good news as of late is the development of promising vaccines. COVID-19 vaccine optimism and in turn a “return to normal” for 2021 has dominated investment news headlines and changed investor’s behavior. This is potentially the beginning of an economic recovery set to accelerate in 2021. I point to dual forces that could propel an economic rebound – shifts in behavior from consumers and corporations — that I expect to generate significant growth for the economy next year. It is expected that as much as $4 trillion in pent-up demand for goods and services from consumers could be spent in 2021 if they begin to feel like there’s a return to normal. Then there’s corporations. With historic highs of corporate cash on their balance sheets, an increase in corporation spending could also fuel economic growth.

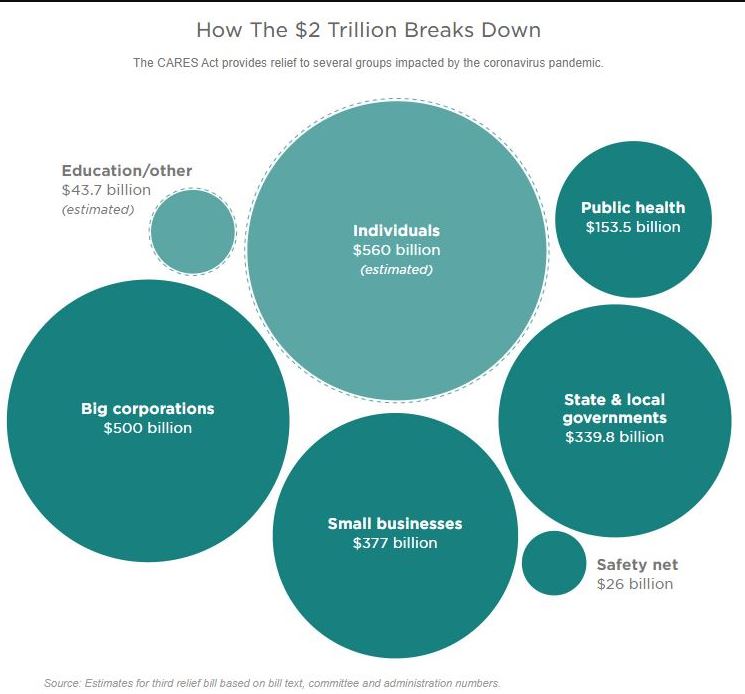

After 2020’s weakest economic period since the Great Depression, the outlook for the economy in 2021 is less rocky and, at least, a little more rosy. I must reiterate, all depends on COVID-19. While a return to pre-pandemic GDP levels is unlikely, a 3-4% rate of growth in the U.S. economy is expected. A continued improvement in the jobs market it critical. No doubt, a new economic stimulus package would help jobs and boost the economy at least short-term. However, with Republicans and Democrats at odds, the timing of a new stimulus bill before Biden’s inauguration on January 20 is still up in the air. Global economic weakness began with the virus in 2020. Let’s hope it ends with a vaccine in 2021.

Wishing you Happy Holidays & Happy New Year!