To repeat how I opened this 6-part series in May, imagine you are watching the game show Family Feud. The always smiling Steve Harvey asks a contestant to, Name a strategy that household decision makers use to improve their lifestyles. We then learn that the “Survey says: Financial Planning!”

I’m sure if that were one of the game show’s questions, the “survey” would answer that question that way.

This month’s Investor’s Edge column begins where last month’s ends, with the third part of a six-part series. The series is about the 6 steps of the financial planning process. The make-up of a comprehensive financial plan includes six elements. “Investment Planning” is the third element of the process.

As an investment advisor and financial planner, I am frequently asked, “How is the market doing?” That is especially true lately with volatility creating more FUD (Fear Uncertainty & Doubt) among investors, and the U.S. stock market indexes back near all-time highs. While I generally answer the general question with a general answer, I have often wanted to answer the question with the question, “How is your plan doing?” That’s the question to ask and have an answer to. Sure, the day’s tweet, merger, political news, or economic development can (and does) move the stock market—and does in a big way, both up and down. Your financial plan, though, should be rooted in stronger soil than the stock market alone.

Financial planning, as I want to emphasize with this series, is so much larger than just investing. It involves a wide range of topics such as education and retirement planning, tax planning, estate planning and more. Hence, the word “planning.” So, while financial planning and investing are often misunderstood and sometimes thought of synonymously, they are different.

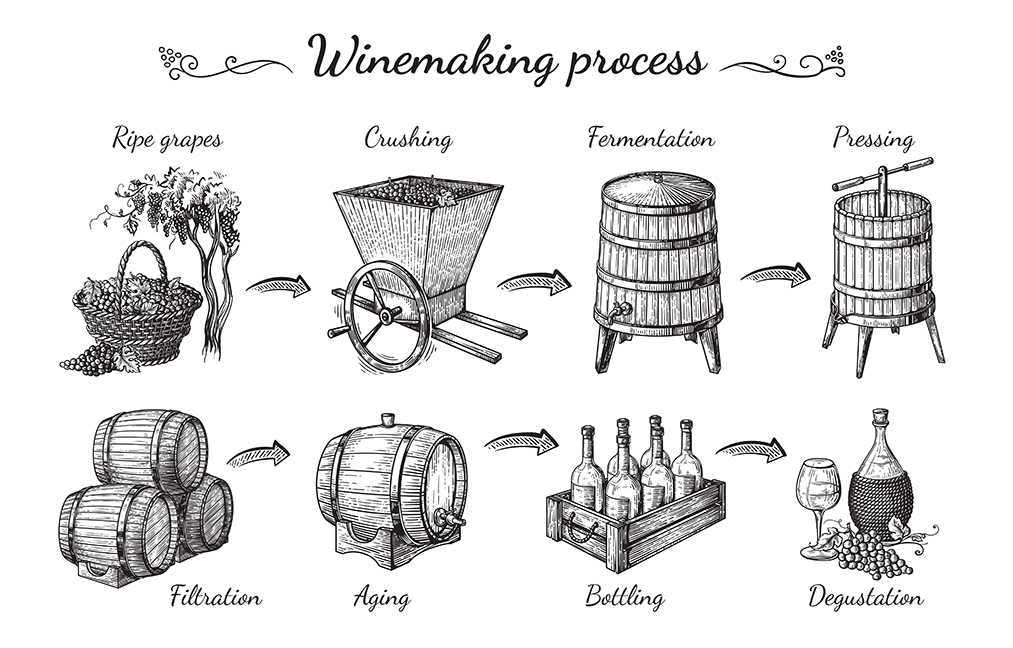

Then there are investments and the work required in the selection and investment management process. Think of a road map—or nowadays, WAZE, your GPS—and a car. Your financial plan is your map. You program it with where you want to go. Your car is your investment plan. A suitable investment plan will drive your assets with the guidance of your map, your financial plan. Together, they will get you where you want to be financially. Then think of the car’s model. Is it a Chevy Suburban, Cadillac or Corvette? The “model” is your investment portfolio. Those stocks, bonds, properties, mutual funds, etc., will determine how safely, comfortably and quickly you get where you want to go. Like your GPS system or map, your investment plan is a navigational aid. It should identify your destination and show how to plan to get there by specifying the asset classes and security types you will use. It should establish the “rules of the road.” Essentially, your GPS should be driven by your IPS—your Investment Policy Statement. So, your investment plan, governed by your IPS, will clearly reflect your unique investment parameters and constraints, such as your risk tolerance, time horizon, income needs, and tax consequences.

Concepts of investment parameters and constraints are unique to you. They reflect you as an investor and will serve to govern how your money should be managed. Combined, your investment constraints and parameters are determining components of your IPS, guiding your investment plan. An investment constraint, for example, is time. Your investment time horizon is a factor that may limit suitable investments for you. Funds from investment needed in 3 – 5 years would preclude you from investing that money in long-term bonds. Your tolerance for risk is also an investment constraint. Another common investment constraint is investment tax consequences. Separately, investment parameters, or investment criteria, should also impact your investment selection. Your need for investment income is an example. Your investment plan, written and guided by your IPS, which state your investment parameters and constraints, should be your focus. Your question when concerned about the market should be, “How is my plan doing?”

As with all goals, committing them to writing is essential. This applies to investment planning. Your investment plan must be written down. That document is your IPS. Make your investment goals S-M-A-R-T. Specific, Measurable, Actionable, Realistic, and Timely. And, put it in writing.

Hope you enjoyed part 3. Look for part 4 of the financial planning process in my Investor’s Edge column in the August issue of ALIVE Magazine.