First of all, I hope all of you and those you love and care about are healthy. A big THANK YOU to all of who are first responders and medical professionals for your service and the care you give. COVID-19 has absolutely changed the way the planet’s population lives. The lives lost and those who are sick because of coronavirus is awful. America’s economic condition is the worst since the Great Depression already and the ultimate damage will likely be worse. The U.S. government cares. The recent passing of the CARES Act expresses that.

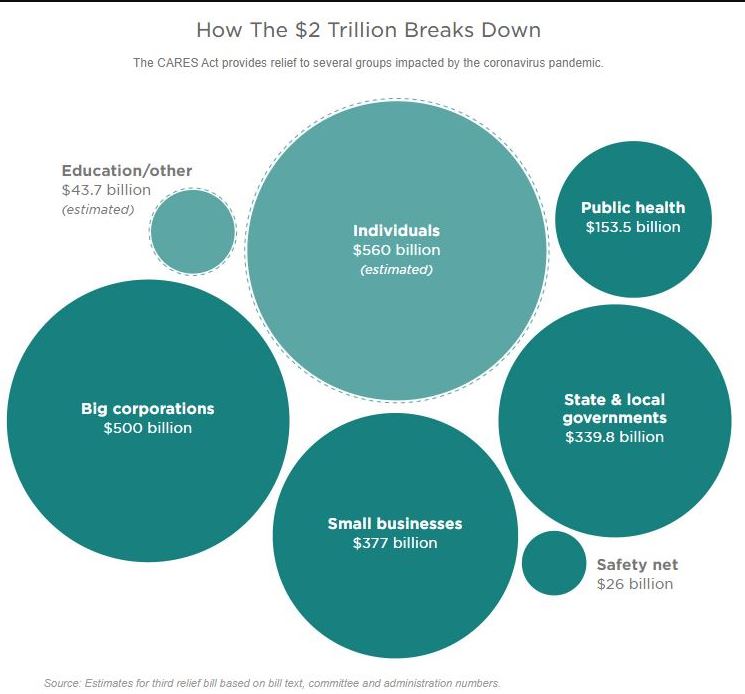

On March 27th, 2020., the Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law. The CARES Act is intended to provide fast and direct economic assistance for American workers and families, small businesses, and preserve jobs for American industries. The bill builds upon earlier versions of the CARES Act known as the Families First Coronavirus Response Act. It is the product of negotiations between Democrats and Republicans for a bipartisan response to the crisis. The bottom line, the CARES Act is a tremendous help to our country. With an attitude of “do whatever it takes”, the government is likely to throw even more trillions of dollars in the combat with coronavirus. The graph below depicts the allocation of the $2 trillion CARES Act. There are seven main groups that would see the widest-reaching impacts:

The CARES Act has been deemed necessary emergency relief. In my opinion, it is much more accurate to call this legislature a “Relief Act” than a “Stimulus Act”. No economic policy can fully end the current hardship so long as the public health requires that we put so much of our commerce on ice. And it will take a vaccine to fight the virus for that condition to completely thaw out. The CARES Act, though, is a positive step forward to provide economic relief to individuals and businesses facing potential economic ruin. Here are some highlights to retirees specific and American families in general:

- Retirees & Retirement Account Holders – – The 10% early withdrawal penalty on retirement account distributions has been waived for taxpayers facing financial challenges due to COVID-19. Withdrawn amounts are taxable over three years, but taxpayers can recontribute the withdrawn funds into their retirement accounts for three years without affecting retirement account contribution limits. Eligible retirement accounts include individual retirement accounts (IRAs), 401Ks and other qualified trusts, certain deferred compensation plans, and qualified annuities. What retirees will find most beneficial is the CARES Act also waives required minimum distribution (RMD’s) in 2020.

- Families – – Cash payments and student loan relief are just two immediate provisions to families from the CARES Act. Cash payments are estimated to total $300 billion. Most individuals earning less than $75,000 can expect a one-time cash payment of $1,200. Married couples would each receive a check and families would get $500 per child. That means a family of four earning less than $150,000 can expect $3,400. The checks start to phase down after that and disappear completely for people making more than $99,000 and couples making more than $198,000. The cash payments are based on either your 2018 or 2019 tax filings. People who receive Social Security benefits but don’t file tax return are still eligible, too. As I noted, student loans benefit also. Employers can provide up to $5,250 in tax-free student loan repayment benefits. That means an employer could contribute to loan payments and workers wouldn’t have to include that money as income.

- All of us – – The IRS has been extended this year’s tax filing deadline to July 15.

I am optimistic that policymakers can build on this bill to ensure individuals and businesses can be victorious over the virus and rebound effectively when the crisis abates. A tremendous effort is underway to develop a coronavirus vaccine. Let’s not hope for a “new normal”. Let’s look forward to the way we lived our lives before the pandemic – that is normal.