Working, saving, investing, and spending are the four pillars of financial life management, or FinLife®, as we call it. We can intuitively understand that the four actions are tightly interconnected, but what may be less obvious is that they are all equally important. While discussion of the fourth pillar, spending, may sometimes be neglected in favor of the other three, we feel that it is so important to a well-balanced FinLife® that we’re devoting an entire month to discussing the subject. After all, even the most diligent savers plan to spend their funds someday.

We’ll start off the topic of spending with a little whimsy. Consider the following sentence:After spending their whole life working,savers often plan to spend their retirement spending their savings. While admittedly repetitive, the sentence illustrates the profound importance generally attached to spending. Part of FinLife® is making choices that allow us to feel like we’re “spending” well.

For those still in the accumulation phase, there is a different nuance: how much they spend dictates how much they might save, which can affect how long they plan to work.Where you are with respect to working, saving, investing, and spending may mean that you need to approach your portfolio differently. Someone who is accumulating assets versus someone who is relying on their investments for cash flow needs (such as in retirement or for college expenses), may likely invest their entire portfolio very differently. United Capital has tools available for many different sets of investors, but let’s focus first on ways someone who is spending down their portfolio might think about investing their assets.

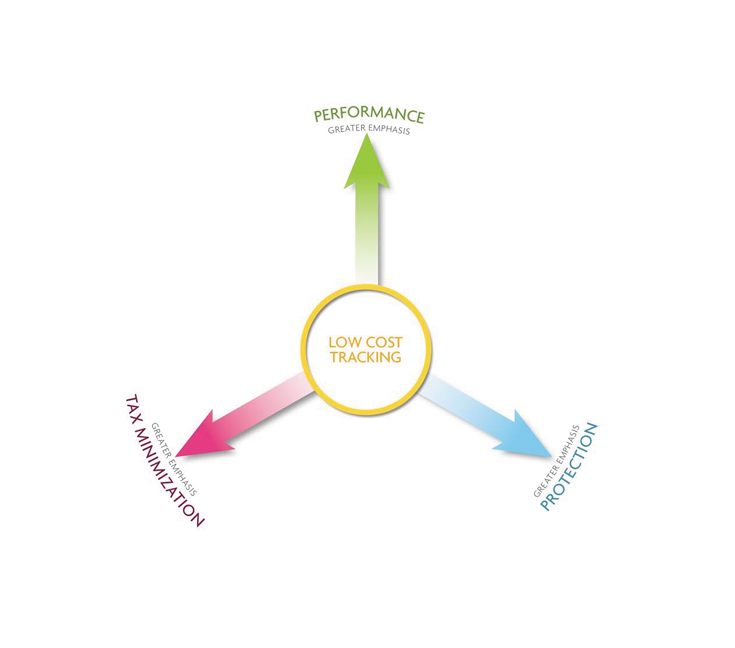

Consider how we think about investing, using a triad of low cost tracking, performance, protection and tax minimization.

Someone who is close to using their portfolio for cash flow needs may want to explore strategies that lie on the Protection axis, for example. These investors may want to attempt to limit downside volatility – even though it may limit upside potential – with the goal of preserving capital from which to draw during retirement.

Other investors, perhaps those already in retirement, may consider a strategy that focuses on income and preservation of capital, which can be found among any of the four attributes of low cost tracking, outperformance, protection or tax minimization, depending on the strategy in question. Indeed, when nearing or entering retirement, some investors may (perhaps incorrectly) approach investing and spending as binary decisions: either they are investing or they are spending. Unfortunately, they may not consider the two in tandem, despite a retirement that may span nearly as long as their working life.

That is where FinLife® comes in. These considerations of working, saving, investing, and spending are not meant to be viewed in isolation, but rather together. Investing in a manner that allows you to spend both prudently and confidently, for example, may be a useful way to approach your particular situation. How much you spend relative to the size of your portfolio can make a big difference to how you invest your assets. For some investors, shifting from an accumulation phase to the distribution phase of their investment process might not necessarily mean an abrupt shift in their entire portfolio allocation. For other investors, careful consideration to their asset allocation may be in order.

Your experienced United Capital financial adviser can help you determine what course best suits you and your particular situation. Considering how near or how far to your investment objectives you are may mean that changing your investment strategy could make sense.

It could also mean that your spending habits may need to change as well. Having discussed how some investors’ portfolios may need to be adapted to their spending needs in retirement;other investors may need to consider whether their spending patterns allow them to save enough to even reach their retirement goals. Since what is spent cannot be saved, if you are far from your retirement savings goals, then it may make sense to consult with your United Capital financial adviser to better understand successful approaches for modifying spending so that you can more reliably save enough.

We can see how these aspects are related. Considering the intersection of these variables may help you determine how to invest your portfolio, either more aggressively or more conservatively, and how much you must save versus spend. In turn, these decisions may affect how long you plan to work. In your financial life, every decision you make affects something else when it comes to working, saving, investing, and spending, and it is important to understand how. And that is the role of your experienced United Capital financial adviser.

Mr. Kelly Trevethan is a Certified Investment Management Analyst & Registered Financial Consultant. He is a Managing Director with United Capital Financial Advisers LLC, a national private wealth advisory firm with 79 offices across the nation. He can be reached at 415-418-2101. To obtain your free copy of the New York Times Bestselling book “The Money Code”, email him at Kelly.trevethan@unitedcp.com.

Disclosures: United Capital Financial Advisers, LLC (“United Capital”) provides financial life management and makes recommendations based on the specific needs and circumstances of each client. For clients with managed accounts, United Capital has discretionary authority over investment decisions. Investing involves risk and clients should carefully consider their own investment objectives and never rely on any single chart, graph or marketing piece to make decisions. The information contained in this piece is intended for information only, is not a recommendation to buy or sell any securities, and should not be considered investment advice. Please contact your financial adviser with questions about your specific needs and circumstances.

Certain statements are forward-looking statements, including but not limited to, predictions or indications of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. There are no investment strategies that guarantee a profit or protect against a loss.

© 2015 United Capital Financial Advisers, LLC. All Rights Reserved

www.unitedcp.com

Leave a Reply