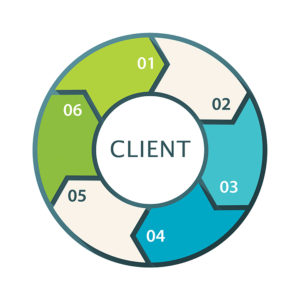

Investing is a process. It starts with a rule book that states your investment plan. This is often referred to as an Investment Policy Statement (ISP). Your ISP should clearly state your general investment goals and objectives, serving as a guide that will govern how your assets are managed. I view the investment planning process as a fluid, six-step check list. The process is essentially an ongoing, lifetime effort. It requires discipline.

I believe a proper investment plan, over time, leads to wealth accumulation and preservation. It is this time in the investment markets, not “market timing,” that results in a secure financial future. Maintaining a long-term, strategic investment plan consistent with your unique investment constraints and parameters will likely deliver returns far superior to “playing the market.”

I am happy to share my experience and thoughts regarding the investment planning process. I will do this in a 2-part series. Today’s article, part 1, will cover the first three steps of the process. I hope you enjoy. Look for part 2 in December’s issue of ALIVE Magazine.

Step 1, as the diagram above shows, is to “Learn About You.” This is critically important if you seek advice from a qualified investment professional. Even if you are a “DYI’r,” choosing to do it yourself, this first step requires that you honestly assess yourself as an investor. For example, one of my favorite questions working with a new client at this early stage is (and one of the most basic), “Are you a loaner or an owner?” In other words, a saver or an investor. This question leads to a conversation about a fundamental trait about the individual. A “loaner”/saver is someone who is ultra conservative, seeking safety and income. CD’s, bonds, bank deposits are the suitable securities for this person. On the other hand, the “owner”/investor is a person who can tolerate some degree of risk to have equity in an investment for a desired higher potential return. My dad, for example, once told me that if I didn’t want any risk, put money in the bank and get some interest. If, instead, I could handle the risk for the chance of a much greater return, then buy the bank stock.

There are many other variables about your “investor-self” you need to recognize and/or your advisor needs to discover about you. I have often said since my early years as an advisor, “I seek to understand before I am understood.” It is imperative that your advisor learns about all the needs and concerns unique to you as an investor.

Step 2 is “Set Investment Goals.” This step should be expressed in your Investment Policy Statement that you write, with or without an advisor. It will establish your investment goals and objectives and direct all investment decisions. Creating your IPS provides guidance for informed decision-making and serves as both a roadmap to successful investing and a bulwark against potential mistakes or misdeeds. Here your investment time horizon, income needs, and tax considerations are stated. Special attention should be given to describing your risk/return profile, including naming asset classes that should be avoided as well as naming preferred asset classes. For example, an individual may have an IPS stating that by the time he is 60 years old, his job will become optional, and his investments will return $65,000 annually in today’s dollars given a certain rate of inflation.

Step 3: “Review Existing Assets.” In step three I strive to diagnose before I prescribe. A thorough, unbiased evaluation and analysis of a new client’s existing investments is done. This is necessary to avoid investment over-concentration, achieve diversification, and determine whether or not current holdings are suitable relative to risk tolerance and consistent with overall goals and objectives. You need to be able to answer critical questions about your investment accounts such as: How much risk am I taking? Do I have a strategy to avoid large losses? What are all the costs I’m paying? Should my asset allocation change? Is my portfolio diversified enough? How should I rebalance my portfolio? I refer here to investment success defined by the 4-E’s: Educate + Evaluate + Eliminate = Enjoy. As you educate yourself more about the investment process, evaluate what you own, and eliminate the bad, you will enjoy a successful investment plan.

We say when SCUBA diving, “Plan your dive and dive your plan.” As investors, we should say, we “plan our investments and invest in our plan.”

I’m looking forward to sharing Part-2 in December’s ALIVE Magazine. Until then, Happy Thanksgiving!

Leave a Reply