Some decisions in life are simpler than others. Choosing between “paper or plastic” at the supermarket (before California banned single-use plastic bags about a year and a half ago) was a much easier decision than whether to buy or lease a car, or when to start receiving your social security benefits.

In the investment world, however, few decisions are easy. An investment decision being contemplated more and more nowadays is mutual funds or ETFs, which is the right investment choice? The difficulty with the decision between the two investment vehicles is compounded by a general lack of knowledge and understanding, and information that is typically biased by the two sides promoting their respective product. Another factor adding to the difficulty of the decision is the relative youthfulness of ETFs compared to the aged mutual fund industry. There were only about 100 ETFs in existence in 2002. By the end of 2016, there were over 1,700 U.S. issued ETFs, representing $3.4 trillion. Conversely, there are a lot more mutual funds, they have been around a much longer time, and there is nearly six times more money in them than ETFs. The first mutual fund was created in 1924. At the end of 2017, there were nearly 9,400 mutual funds issued in the U.S. In total, the money held in U.S. mutual funds amounted to almost $19 trillion at the end of 2017.

In my effort to help make this investment choice a little simpler, I suggest you consider the two from the perspective of taxes and cost. A third significant consideration when deciding between the two investment products is the flexibility of buying and selling (trading) them. Which is the right choice? A look at mutual funds vs. ETFs from these three perspectives will lend an answer:

#1) Cost

ETFs often have lower fees and expenses. ETF expense ratios are typically lower than mutual fund fees. In 2016, the average expense ratio of index ETFs was just 0.23% compared with a 0.82% average expense ratio of actively managed mutual funds and a 0.27% expense ratio for index equity mutual funds, according to Investment Company Institute. Today the cost difference between the two is even greater as ETFs, on average, cost even less. Many mutual funds include a variety of fees in their expense ratio, including fees to cover marketing and distribution costs. Then there is the “transaction cost”—the cost to get in and/or out of them (buy and sell cost). Today, there are many hundreds of ETFs with NO cost to buy or sell. That is not the case even for “no load” mutual funds.

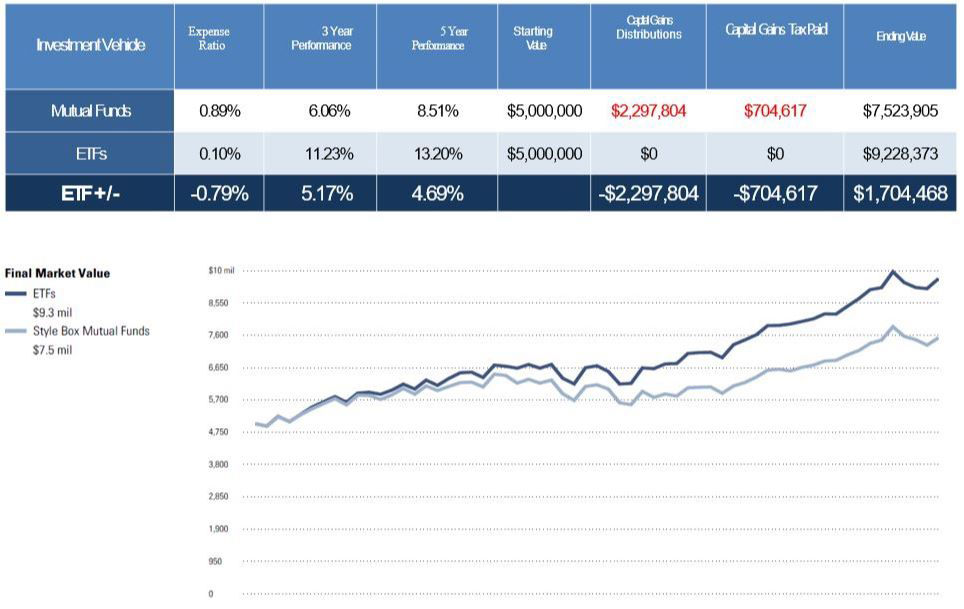

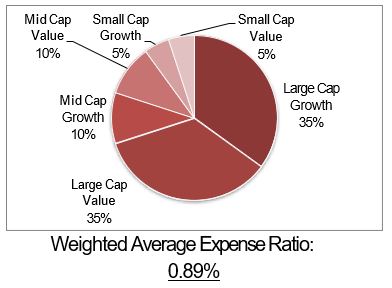

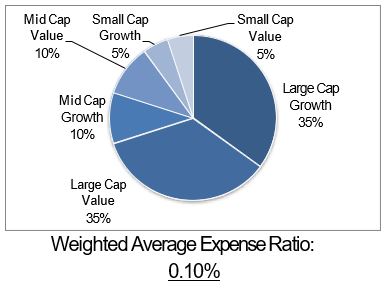

That impressive out-performance by the dark line (ETF portfolio) is due to very low cost and great tax efficiency. The graphs below depict that. The mutual fund portfolio cost is nearly 9x more than the ETF mix.

The red is a sufficiently diversified mutual fund portfolio allocation. The blue portfolio is the same allocation for a portfolio of ETFs. Even with the same investment asset classes held for same time period and gaining the same annual return on investment, the compounding cost savings in the ETF portfolio will result in a greater overall investment return than the costlier mutual funds. In addition to the lower costs, ETF investments are also much more tax efficient.

#2) Tax Efficiency

ETFs are more tax efficient than mutual funds. ETFs and mutual funds have the same tax consequences when it comes to capital gains taxes and taxes on dividend income. However, investors can control their capital gains from ETFs. You cannot with mutual funds. Like a stock, investors can defer tax on gains from an ETF until they sell it. This is much more tax efficient than mutual fund investments that trigger a capital gain tax liability every year that the fund company sells holdings in the fund at a profit. This is essentially every year. So, the mutual fund owner is paying capital gain taxes even if he/she doesn’t sell anything. That just takes away from the overall return on the investment.

#3) Flexibility

ETFs offer more trading flexibility. ETFs trade like stocks, as they are “listed” on major U.S. stock exchanges. Tick-by-tick, ETFs’ share prices change second-by-second every trading day. At any time in a market trading session, an investor can buy or sell ETF shares. This is significant. Mutual funds, instead, can only be purchased or sold at the end of a trading day—after the market closes and their price is determined (based on Net Asset Value—the value of fund assets minus liabilities divided by the number of shares. Imagine the difference in selling an ETF early in the morning of a big down day versus selling a near identical mutual that same day and forced to receive the end of day price for it. This could easily result in 3 or 4%, or greater difference. Then, think of the other side of this coin. A mutual fund investor on the buy side, again forced to get the end of day price, misses out on any gain in a big up market day. The ETF buyer, able to buy early during the trading session, gets the day’s gains.

I hope this helps you make the right choice between mutual funds and ETFs. Back to the buy or lease, or when start Social Security questions—I consult other professionals for those answers.

Leave a Reply