Nothing in life is certain but death and taxes, is a saying attributed to old Ben Franklin. Actually, taxes have been around for quite some time. The Sumerians collected taxes and kept meticulous records of these collections, right around 4000 BC. The Ancient Chinese collected taxes as well as the Ancient Egyptians and of course, the Romans.

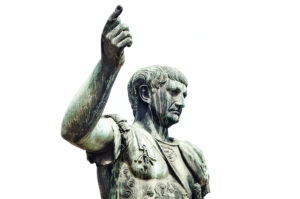

So, why that title, you ask. It was my lame attempt at comparing Sacramento to Caesar’s Rome, because, Rome’s taxation philosophy was as convoluted as Sacramento’s is. In Rome, everything depended on which Caesar was in charge and how much money he needed to finance the building of roads and bridges, maintain his legions and insure the safety and security of the citizens. Caesar’s Rome and Sacramento are very much alike in the way revenue is generated. As in Rome, over two thousand years ago, Sacramento levies taxes on wealth, personal property, commerce, and whatever else the legislature deems necessary; such as vehicles of all sorts (chariots?).

The Governor of California and his legislative band of merry men have found clever ways to syphon tax dollars right out of our pockets, without much fanfare, so that most of us aren’t even aware of how our hard-earned dollars are slipping away.

Just recently, Sacramento came up with a new means of relieving us of more of our hard-earned dollars. It’s called the TIF or Transportation Improvement Fee. Did you notice how Sacramento didn’t call TIF a TAX, rather it’s called a fee. It should really have been called STIF because we’re getting stiffed. I had not heard of TIF before, so I had to look it up on the web. What this scheme does is, first, it raises our annual vehicle registration fees by $25 to $175 per year, depending on the value of our vehicle, and second, it increases the taxes on gasoline by twelve cents per gallon. I didn’t see this TIF coming. Some of you probably did.

I happened upon this clever, little scheme because my vehicle license renewal fee came due, just this past May (2018). To my surprise, as my vehicle had gotten older, instead of my renewal fee coming down, as it used to in the past, it started going up. I asked, “but why?” So, I did some more digging.

I drive a thirteen-year-old Ford Sport Trac (a cross between a Ford Explorer SUV and a pickup truck), which I happen to like but Ford no longer makes. Which is a story for another day. Anyway, here are some actual figures for you, so you can see what I’m talking about. In 2016, I paid $188 for my renewal. In 2017, my cost went up to $198; but I didn’t squawk. However, this year (2018) it jumped up to $226. “What’s the big deal?” you might ask, “so, you pay 28 bucks more.” You’d be right. By itself, that $28 jump doesn’t mean much. It doesn’t even pay for a dinner for two at your local greasy spoon diner. However, if you add that to other changes in taxation, it may just start shedding some light on why your pocketbook seems to be getting thinner. And of course, if my Sport Trac lasts another ten years, I’ll be paying more for my renewal fee than the vehicle will be worth.

So that I can drive my Sport Trac, I have to fill the gas tank about twice a month, with around 20 gallons of fuel. We Californians are paying, we are told, around 71.9 cents per gallon in taxes; but with all that SCT (Sacramento Creative Taxation) we’re actually paying a lot more. Here is a breakdown of the taxes we pay on every gallon of gas we put in our vehicles: 39.5 cents (and possibly going up) for state excise tax, 30-42 cents for sales tax, depending on which community and county we live in, 10 cents for cap and trade fee (that’s a tax on top of a tax) and 18.4 cents federal excise tax, for a grand total of between 97.4 cents and $1.09 per gallon. So, if you notice your per gallon of gas cost go up, it’s not always because of the dastardly oil companies; sometimes it’s uncle Sacto.

To put it simply, even if we take the lowest stated total tax of 71.9 cents per gallon of gas and I buy 20 gallons, $14.38 go to the various taxes, each time I fill my gas tank. And, 39.5 cents per gallon of that is California’s excise tax. Total minimum taxes on my gas purchase for the year amounts to around $345. Of that, Sacramento gets $7.90 every time I fill-up. For the year, that makes another $189.60 in tax dollars that go to Sacramento.

What is all this extra revenue supposed to fund, you ask? The Governor promised that the 12 cent-raise in gasoline tax, would all go toward maintaining and repairing our decrepit roadways and bridges. If you’ve driven any distance lately, you must have come to the realization that our street and highway surfaces are in bad need of repair as it appears that not much has been spent for maintenance, for years. So where exactly is all that money going to?

The official word from the Governor’s office is that all this revenue, around $52 billion over a ten-year period, was to be used for the state’s deteriorating roads and bridges, and nothing else. However, according to some observers, about 30% of the new revenue is already being diverted by the party in charge, for pet projects in their own districts that have little or nothing to do with rehabilitating the roadways and bridges for our vehicles.

Apparently, Sacramento can use these funds acquired under SB1 ‘as long as they all deal in some form or other with transportation needs in general’ even though not directly with repairing roads and bridges. They’re pretty clever in Sacramento! Somehow, they always manage to misdirect our attention and explain away some of the backhanded ways in which our gas tax dollars are being misused.

Here’s a good example: CALPERS, or California’s Public Employee’s Retirement System, the nation’s largest public pension fund is in trouble, and has been for years. The governor was hoping to raise gas taxes by as much as a whopping 42% (remember, that is not 42 cents per gallon), to make up for all the funds lost due to poor management and impotent investment practices. Some of the current gas tax revenue, might be diverted into CALPERS to reconcile some of the losses.

According to some interpretations, SB1 supposedly allows some of the revenue to be used for the construction of the California High Speed Rail System which has been eating up cash faster than a California wildfire. Of course, this project has nothing to do with fixing roads or bridges. So, anyway you cut it, Sacramento can do pretty much what it wants with some of that gas tax money, as long as they have a clever way of disguising the explanation.

According to various sources, between 4 and 5 million Californians have left the Golden State in the past ten years, to be replaced by 3 to 4 million people from other states, Mexico and other foreign countries, for a net loss of about 1 million. That means, 1 million less taxpayers in California. Most of those residents have in fact left because of the skyrocketing cost of housing and living, in addition to excessive taxation. I have personally talked to several former Californians who have moved out of the Golden State, and are now living in Reno and Tahoe, Nevada. A most recent escapee from California we’ve known for a dozen years, couldn’t afford housing here and left for Arizona. A couple of others moved to Oregon of all places. They all cited soaring cost of housing and excessive taxes.

California now basically has three economic classes: 1-The Ultra-Rich, 2-the Working/Middle Class and 3-the Poor, or those in need of assistance, working or not. And guess what? 1 and 2 pay for all the assistance that 3 gets.

In addition to the gas tax, which is one of the highest in the nation, Californians now have the new, elevated vehicle renewal fees (not taxes?). Add to that, the California Income tax, with rates ranging from 1% for very low incomes, all the way to 13.3% for the Ultra-Rich, one of the highest sales taxes in the nation at 7.25%, with additional local taxes added (Sales tax in Concord = 8.750, Danville = 8.250). Finally, we have property tax. The rate happens to be one of the lowest in the country, with an average of 0.74%. However, due to soaring home prices, it has turned into quite a hefty chunk of change out of our pockets, twice a year.

Adding it all up you can see that California is in fact hitting us tax-wise from all sides. Isn’t it interesting that somebody came up with a Proposition 69 on the June ballot, to ensure that the money you and I approve for transportation projects, will really, truly be used for transportation projects only and will not be used as some of slush fund to be spent by Sacramento politicians on their pet projects? You probably don’t even want to know how much money Sacramento spends on the 3 million illegal emigrants and their 1.1 million American born children; which also happens to come out of our pockets.

And before I forget, driving along highway 24 and merging to I-680, I saw the signs indicating where the “Toll Lane” begins. That’s what I had forgotten: we pay tolls, when we cross any of the bridges across the San Francisco Bay, and the latest Sacramento invention, Toll Lanes. We’ve been paying toll on the bridges since they were built. Some of you might not even remember a quarter toll, to cross the Bay Bridge; yes, twenty-five cents. The new toll on the very same bridge is now $6.00, 5:00 am to 10:00 am and 3:00 pm to 7:00 pm, $5.00 on weekends and $4.00 at other hours. The Bay Area Toll Authority Oversight Committee or BATAOC, unanimously voted to put on the June ballot a raise in tolls to $9.00 for the Bay Bridge and $8.00 for all other bridges. Isn’t it interesting how this tax is called a TOLL. There you go again Sacramento; playing with words! If you work in the city, I’m sure it will add a bit to your driving costs. But hey, they’ve made it easy for us. It’s called FasTrak and, you can now use it in the Toll Lanes. And guess what? Rome had toll roads. Unfortunately for Caesar, they didn’t have FasTrak.

Please try to remember, this is just my opinion: we are paying way too much in taxes, fees and whatever else you want to call it, and Sacramento politicians are just too carefree with where and how, they spend it. Now, if in your opinion, we are not paying enough in taxes, bless your heart, you may voluntarily contribute to Rome’s folly… pardon me, Sacramento’s folly to your heart’s content. As far as I’m concerned, the Golden State is fast losing her luster, thanks to Sacramento greed and mismanagement. I just hope that California doesn’t go under, like Rome and become just another sorry state.

Leave a Reply