Excessive greed and fear are the emotions that drive the public markets. Sometimes fear and greed can double time you, which is expressed by FOMO (the fear of missing out.) Too often emotions cause individual investors to take costly actions. What I hope to help you avoid is buying high and selling low.

In my career as in investment advisor over 36 years, I have seen extreme market drops that created fantastic opportunities to BUY stocks. Instead, many individual investors were overwhelmed with fear and chose to SELL. 1987, 1994, 1998, 2000, 2008, and 2020 were some of those times of deep drops and down markets. My efforts to offer proper perspective and prudent, rational advice to investors was unsuccessful. The power of the fear emotion was too strong; “Get me out,” was the response. Less so in the 2020 “Virus Crisis” bear market because it happened so fast, but the steep sell-off in stock prices caused most investors a lot of FUD (fear, uncertainty & doubt).

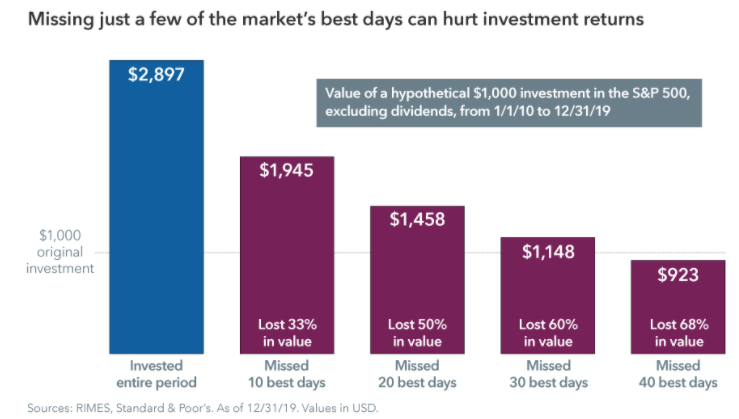

You wouldn’t be human if you didn’t fear loss. No one likes to lose. Especially money. Behavioral finance studies have determined that people feel the pain of losing money more than they enjoy gains. Natural instincts cause us to want to flee the market when it starts to plummet, just as greed moves people to jump back in when stocks are soaring. Both can have negative impacts. While many investors have lost money in the stock market, they didn’t have to. Here are 3 things you can do to avoid losses in stocks and should keep in mind particularly during down markets: remember your time, do your homework, and control your emotions. It’s time in the market, NOT market timing that determines your investment success. Remember your investment time horizon when the fear driven desire to sell hits. Knowing yourself and knowing your investments will reduce the urge to sell in a down market. Do the necessary homework to understand the stocks you own. Ask yourself, “Will the company’s product or service remain in strong demand beyond the temporary down market?” Lastly, do your best to control your emotions. Fear and greed are awfully strong but reminding yourself of your investment years ahead and your confidence in the long-term prospects of the companies you own can make you a stronger investor.

Here are three helpful facts to keep in mind. Keeping proper perspective should help you overcome the power of emotions and fight the urge to sell in down markets:

- Down markets are normal

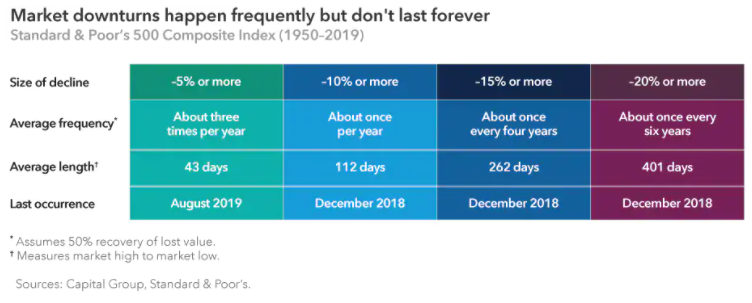

History has shown us that stock market declines are an inevitable part of investing. Down markets are normal. There are two kinds: corrections (defined as a 10% or more decline), and bear markets (a 20% or more decline). The good news is that these and other challenging market downturns don’t last forever. The table below show the S & P 500 Index has typically dipped at least 10% about once a year, and 20% or more about every six years, according to data from 1950 to 2019. (The 2020 bear market fell over 30% and fully recovered to pre-crash highs in 6 months).

- Its time in the market, not market timing

- Diversification matters

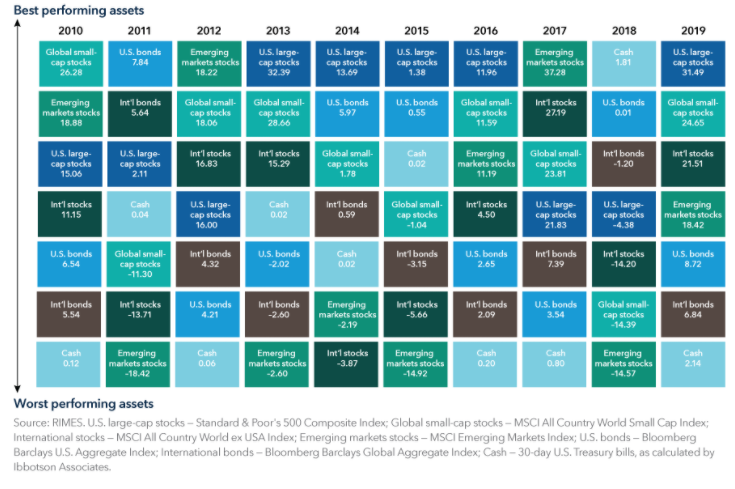

“Don’t put all your eggs in one basket.” You heard that before. The inference is to diversify your investments. Diversification can help lower volatility and help to reduce some of the stress of down markets. A diversified portfolio doesn’t guarantee profits or provide assurances that investments won’t decrease in value, but it does help lower risk. As the chart below shows, investment asset class performance can swing from first-to-worst, and vice versa from year to year. How you diversify best is to be clear on your risk tolerance, time horizon, income needs and other investment parameters and constraints unique to you.

You can control your emotions with your investments. The that end, I hope these considerations help.

Leave a Reply